Estimate call & put prices and the Greeks with Black‑Scholes.

Enter the underlying price (S), strike (K), time to expiration (T), risk‑free rate (r), dividend yield (q), and volatility (σ). The calculator outputs theoretical European option prices plus Delta, Gamma, Theta, Vega, and Rho.

The Black‑Scholes model is designed for European‑style options (exercise only at expiration). For American‑style options (exercise anytime), Black‑Scholes is often used as an approximation; binomial / numerical methods may be more appropriate.

Results

N(·).

-

Inputs:

S(stock price),K(strike),T(years),r(risk‑free rate),q(dividend yield),σ(volatility). -

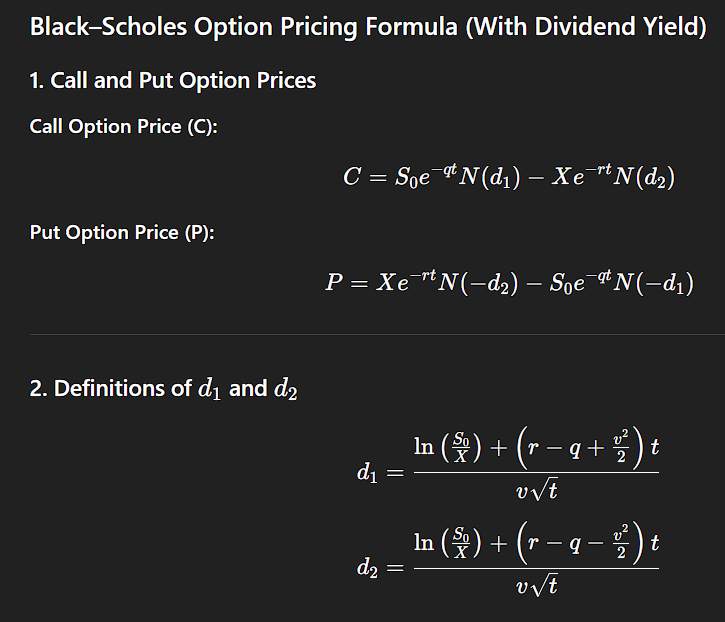

d1 and d2:

d1 = [ln(S/K) + (r − q + 0.5σ²)T] / (σ√T)

d2 = d1 − σ√T -

Call and put prices:

C = S e^(−qT) N(d1) − K e^(−rT) N(d2)

P = K e^(−rT) N(−d2) − S e^(−qT) N(−d1) -

Greeks: Delta, Gamma, Theta, Vega, and Rho are computed from

d1,d2, and the normal PDF.

- European exercise: early exercise is not modeled (American options need other methods).

- Constant volatility: real volatility changes over time; smile/skew can matter.

- Constant rates:

randqare assumed constant overT. - No transaction costs: commissions, taxes, and slippage are ignored.

For dividend-paying stocks, using a reasonable q can materially change prices and Greeks.

Black Scholes Model Calculator : Price Call & Put Options

A Black Scholes model calculator is one of the fastest ways to estimate the theoretical fair value of a stock option (especially a European-style option) and to compute the Greeks—the risk sensitivities traders use to understand how option prices may change.

What is a stock option? (Calls, puts, and basic terms)

A stock option is a contract tied to an underlying stock (or ETF/index) that gives the holder a right (but not an obligation) related to buying or selling the underlying at a fixed price.

Call option (Call)

A call gives the buyer the right to buy the stock at a specified price (the strike price) on or before expiration (depending on style). Calls typically gain value when the stock price rises.

Put option (Put)

A put gives the buyer the right to sell the stock at the strike price on or before expiration. Puts typically gain value when the stock price falls.

Key option terms you’ll see in any option price calculator

- Underlying price (S): current stock price

- Strike price (K): price at which the option can be exercised

- Expiration: date when the contract expires

- Time to expiration (T): time remaining, often expressed in years (e.g., 0.25 for 3 months)

- Premium: the market price you pay (or receive) for the option

- European vs American style:

- European: exercise only at expiration

- American: exercise any time up to expiration (common in U.S. equity options)

How do you know what is a “fair price” to pay for an option contract?

Options trade in markets, so the price is ultimately set by supply and demand. But many traders and analysts still want a benchmark, what price does a standard model imply given reasonable assumptions?

A common framework is to break an option’s premium into:

1) Intrinsic value (what you’d gain if exercised immediately)

- Call intrinsic value: max(S − K, 0)

- Put intrinsic value: max(K − S, 0)

If a call is already “in the money” (S > K), it has intrinsic value.

2) Time value (extra premium for uncertainty before expiration)

Even if an option has no intrinsic value today (out-of-the-money), it can still be worth something because the price could move before expiration. Volatility and time are major drivers of time value.

Where Black‑Scholes fits

The Black Scholes model produces a theoretical option value based on:

- current price (S)

- strike (K)

- time (T)

- risk‑free rate (r)

- dividend yield (q)

- volatility (σ)

So a Black‑Scholes options calculator gives you a model fair value under its assumptions. Market prices can be above or below this value because of:

- demand/supply imbalances

- volatility skew/smile

- early-exercise value for American options

- discrete dividends

- transaction costs, funding constraints, and more

What is the Black Scholes model?

Black‑Scholes is a mathematical model that estimates the price of a European call or put assuming:

- the stock price follows a lognormal process

- volatility and interest rates are constant

- markets are frictionless (no transaction costs)

- the option can be continuously hedged

Many calculators also add dividend yield (q) to better match dividend-paying stocks by modeling dividends as a continuous yield. In 2026, Black Scholes remains a standard baseline because it’s fast, widely understood, and produces not only prices but also the Greeks (risk measures).

Inputs in a Black Scholes model calculator

A typical black scholes model calculator asks for these six inputs:

1) Stock price (S)

The current market price of the underlying. For liquid stocks, use the latest quote; for wider spreads, consider mid-price.

2) Strike price (K)

The contract strike (e.g., 350). Different strikes produce different fair values and Greeks.

3) Time to expiration (T)

Usually expressed in years:

- 1 year = 1.0

- 6 months ≈ 0.5

- 30 days ≈ 30/365 ≈ 0.0822

Many people search Black Scholes Model calculator days to expiration”—the key is converting days to years consistently.

4) Risk‑free rate (r)

An annualized interest rate used for discounting (often proxied by government yields). Some calculators assume continuous compounding.

5) Dividend yield (q)

A continuous dividend yield estimate. If the stock pays no dividends, set q = 0. Why this matters: dividends reduce the expected forward price of the stock relative to the spot, which can lower call values and raise put values.

6) Volatility (σ)

The annualized standard deviation of returns. This is the most sensitive input and usually the hardest to estimate.

You might use:

- historical volatility (computed from past returns), or

- implied volatility (backed out from market option prices)

This is why people also search implied volatility Black Scholes calculator (implied vol is what makes the model match market price).

How Black Scholes Model calculator call and put prices

The model uses two intermediate terms: d1 and d2.

Use the standard normal CDF N(⋅)

N(x) represents the probability that a standard normal variable is less than xx. Black‑Scholes uses this to weight expected payoffs. A well-built calculator shows C, P, d1, d2, and ideally also the Greeks.

Worked example

Suppose:

- S = 400

- K = 350

- T = 1 year

- r = 3%

- q = 1%

- σ = 20%

A Black Scholes calculator will compute d1 and d2, then output a theoretical: Call price (C) and Put price (P)

Different calculators may show slightly different results due to:

- day count convention (365 vs 252 trading days)

- rounding

- continuous vs discrete compounding approximations

- numeric precision of the normal CDF

But this setup is a good benchmark scenario for testing any black scholes model calculator you build or use.

How to use a Black Scholes model calculator (step-by-step)

Step 1: Enter S and K

- Stock price (S): current market price

- Strike (K): the contract strike

Tip: If you’re comparing multiple strikes, keep S fixed and change K.

Step 2: Enter time to expiration correctly

Choose one:

- Years (e.g., 0.5), or

- Days (e.g., 90 days → 90/365 years)

Tip: For long-tail searches like “Black‑Scholes calculator 30 days”, the key is not the number of days—it’s the conversion method.

Step 3: Enter rates and dividends as annual percentages

- r = risk-free rate (e.g., 3%)

- q = dividend yield (e.g., 1%)

Tip: If you ignore dividends for a dividend-paying stock, your call price can be biased high and your put price biased low.

Step 4: Enter volatility (σ) as annualized %

This is the biggest driver of time value.

- Higher σ generally increases both call and put values (more uncertainty)

Tip for “black scholes model calculator implied volatility” users: implied volatility is the σ that makes the model price match the market premium. If you have market price and want σ, you need an IV solver (not just the pricing formula).

Step 5: Review outputs: Call, Put, and Greeks

A good calculator provides:

- Call price (C)

- Put price (P)

- d1, d2

- Greeks: Delta, Gamma, Theta, Vega, Rho

Understanding the Greeks

Many people search Black Scholes Greeks calculator because Greeks translate the model into risk intuition.

Delta (Δ)

Approximate sensitivity to the underlying price:

- Call delta ranges ~0 to 1

- Put delta ranges ~-1 to 0

Rule of thumb: delta is “how much the option price changes if the stock moves $1,” though it’s not perfectly linear.

Gamma (Γ)

How fast delta changes as the stock moves. High gamma means delta can change quickly (common near-the-money, near expiration).

Theta (Θ)

Time decay—how the option price changes as time passes (often shown per day). Typically: long options have negative theta (lose value as time passes), all else equal

Vega (ν)

Sensitivity to volatility. If volatility rises, option premiums often rise; vega estimates how much.

Note: Some platforms quote vega per 1% vol change rather than per 1.0. A good calculator lets you choose.

Rho (ρ)

Sensitivity to interest rates. Often smaller impact for short-dated equity options, but it matters more for longer maturities and rates environments.

Assumptions and limitations

This section is crucial for anyone using a Black‑Scholes calculator for American options or real-world trading.

1) European exercise assumption

Black‑Scholes is designed for European options. Many U.S. equity options are American-style, meaning they can be exercised early.

- For many non-dividend calls, early exercise is often not optimal, so Black‑Scholes can be a decent approximation.

- For puts and dividend-paying calls, early exercise can matter.

If you need early-exercise modeling, many traders use:

- binomial trees

- finite difference methods

- other numerical models

2) Constant volatility (σ is not constant)

Real markets show:

- volatility clustering

- volatility smiles/skews

- jumps (sudden price moves)

Black‑Scholes uses a single σ for the whole life of the option. In practice, implied vol varies by strike and expiration.

3) Constant interest rates (r) and dividend yield (q)

Rates and dividends can change. Modeling q as continuous yield is an approximation, especially for discrete dividend payments.

4) Lognormal price dynamics and no jumps

The model assumes continuous paths (no sudden jumps). Earnings announcements and macro shocks violate this.

5) No transaction costs, perfect liquidity, continuous hedging

In reality, hedging is discrete and costs money, and liquidity varies (spreads widen in stress).

What this means for fair price?

Think of Black‑Scholes as:

- a consistent benchmark,

- a way to compute Greeks,

- a starting point for comparing market prices and implied vol

Not as a guarantee of what an option “should” trade at.

Practical tips for better results

These tips align with long-tail searches like (how to use Black‑Scholes calculator correctly).

Tip 1: Use consistent units

- If σ is annualized, T must be in years

- If T is in days, convert to years using your chosen convention (365 is common)

Tip 2: Prefer implied volatility when comparing to market prices

If you’re trying to explain the market premium, implied volatility is usually the correct σ input. Using historical volatility can be very different from market pricing.

Tip 3: Don’t ignore dividends for dividend-paying stocks

If you want a Black‑Scholes calculator with dividend yield, set q to a realistic estimate. Even small q can shift call/put prices and deltas.

Tip 4: Remember American-style reality

If you’re pricing a U.S. equity option, understand the model’s limitations. Use Black‑Scholes as a baseline, not a final answer.

Tip 5: Validate with put-call parity intuition

With dividends, European options satisfy put-call parity: C−P=Se−qT−Ke−rTC−P=Se−qT−Ke−rT

A good calculator’s call and put should approximately satisfy this relationship (within rounding).

FAQs/Frequently Asked Questions

You can explore Similar Calculator like this Free SCHD dividend calculator.